Image credit: Pexels

While marijuana remains a Schedule I drug under federal law, the retail market for legal marijuana is projected to reach nearly $57 billion by 2028, reflecting the public’s shifting attitude toward the industry as a whole.

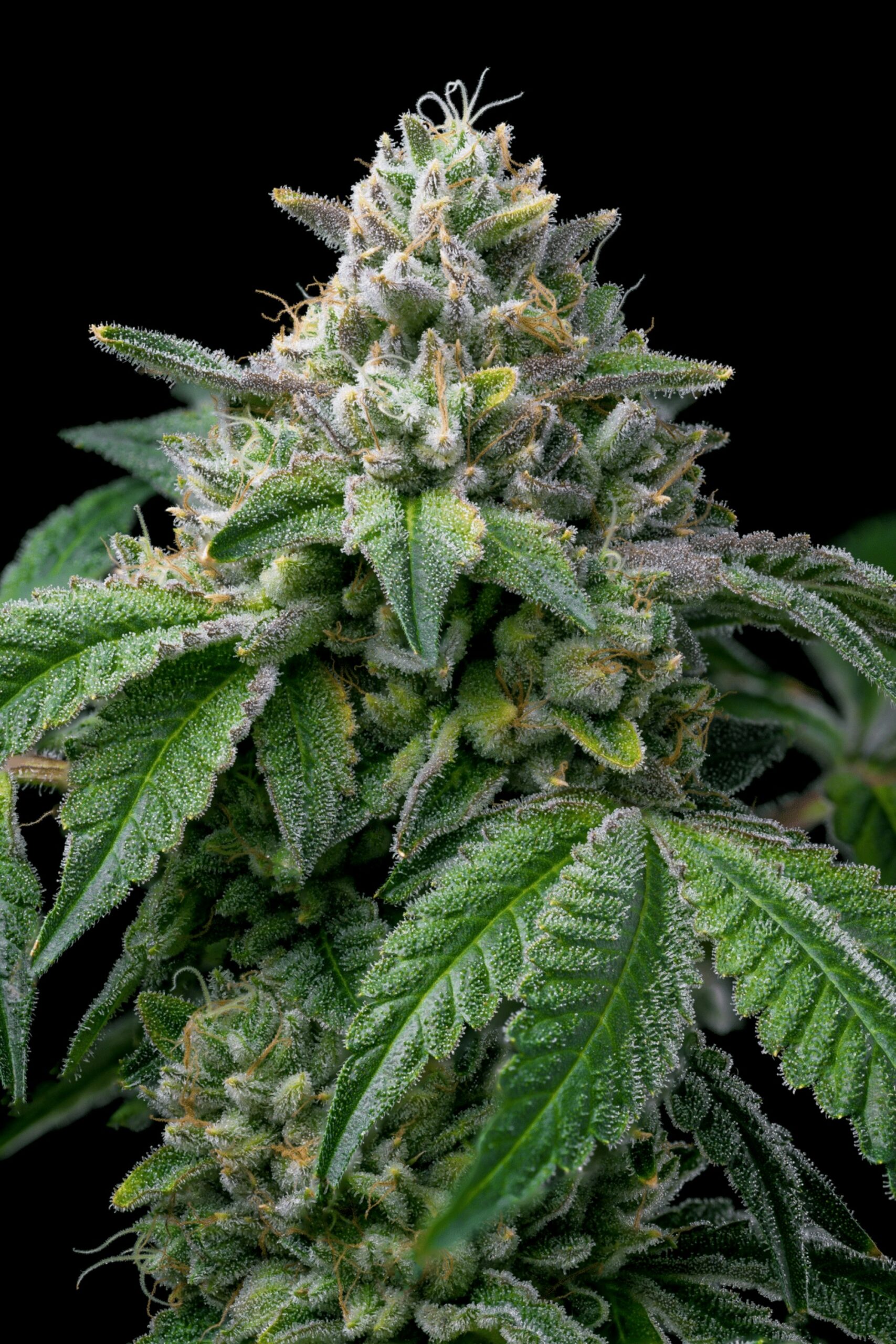

Americans Are Using Marijuana More

In 2013, only 7% of Americans reported that they smoked marijuana. In 2024, that number has more than doubled to 15%. Age is a significant factor, with 26% of those aged 18 to 34 reporting that they have smoked marijuana, while only 11% of those 55 and older reported the same. As the population continues to age, marijuana is likely to become more accepted throughout the country.

Moves for Reclassification

Thirty-eight states and the District of Columbia have legalized medicinal marijuana, while 24 states and the District of Columbia have legalized recreational use. As it stands, more than half of Americans feel that the use of marijuana should be legal, possibly a factor behind the Justice Department’s recent proposal to reclassify it as a Schedule III drug.

Such a reclassification would still mean marijuana is illegal at a federal level, but it could be dispensed by prescription, and some penalties for unlawful possession would be reduced. President Joe Biden has a history of pardoning marijuana-related offenses, and he was partly behind the push for a Schedule III reclassification.

Reclassification’s Research Benefits

Reclassification would also enable further research into the effects of marijuana, which under Schedule I restrictions was defined as having “no currently accepted medical use and high potential for abuse,” by the United States Drug Enforcement Administration (DEA). Medical research could uncover legitimate benefits of the drug under Schedule III classification, potentially leading to full legalization if little to no harmful effects are discovered.

The SAFE Banking Act

Reform advocates also look to the proposal of the SAFE Banking Act, which would significantly benefit marijuana businesses. Since the drug remains illegal under federal law, banks and financial services avoid providing access to marijuana businesses to comply.

Currently, banks can lose their deposit insurance for allowing a marijuana business to open an account or borrow money. The act would prohibit federal regulators from penalizing a bank for providing services to marijuana businesses so long as those businesses are state-sanctioned. Local and regional banks may accept the risk but avoid the industry.

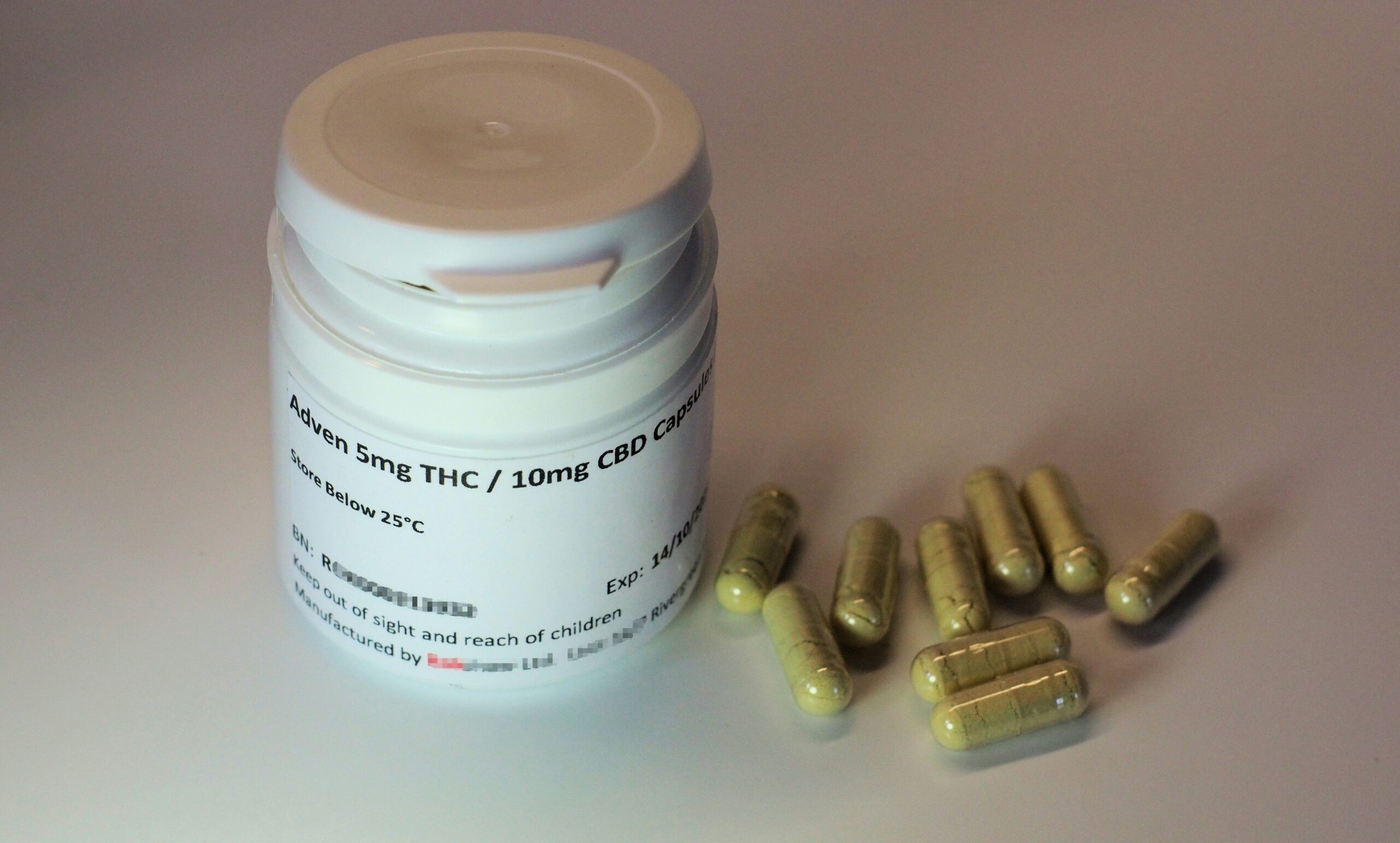

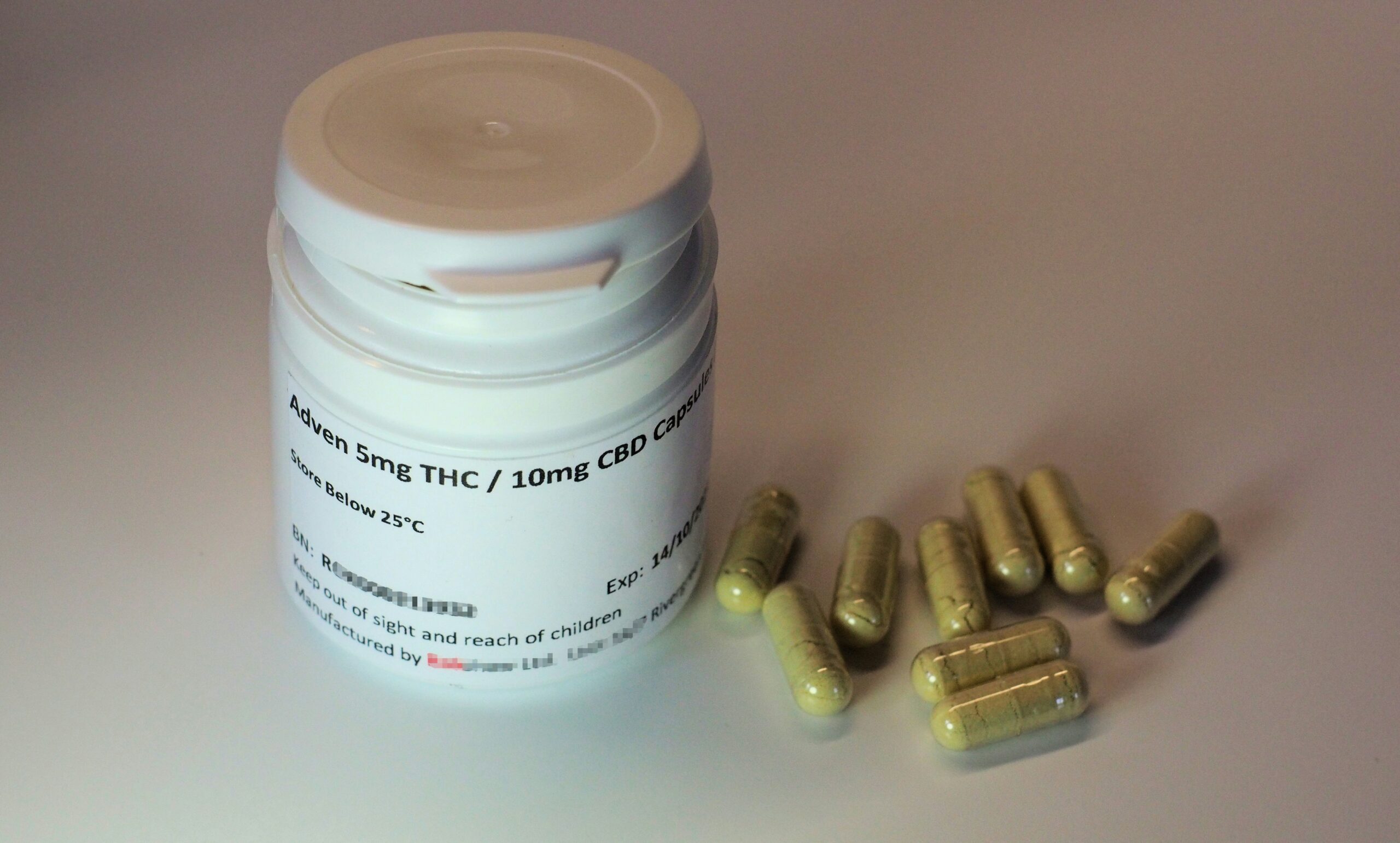

CBD and the FDA

CBD is another point of federal contention, but every state allows the non-psychoactive compound except Nebraska. CBD supposedly provides relief for pain, anxiety, and depression and is frequently sold in oils, creams, gummies, and pills. The market for these and other products will grow to $108 billion by 2032.

The United States Food and Drug Administration (FDA) regulates CBD products, and it remains illegal to market food products and dietary supplements containing CBD. In a statement, FDA commissioner Scott Gottlieb, M.D. suggested that the department would work with Congress to address the public’s desire for CBD products and legitimate safety concerns.

An Industry Poised for Growth

Whether the drug is legalized on a federal level or the SAFE Banking Act is passed, the industry is poised to consolidate and grow into a much larger one. State regulations continue to loosen into legalization, making federal legalization seem like it will only be a matter of time. Proposals like the SAFE Banking Act only serve to accelerate the process and the profitability of marijuana businesses.

It is unlikely that the current administration will make such drastic changes before leaving office, but advocates remain hopeful for the future. The marijuana industry has already grown to a significant size, and any loosening of regulations is sure to establish it as an economic mainstay.